In the intricate world of venture capital (VC), one concept towers above all: the power law. This phenomenon not only determines how returns are distributed across investments but also challenges our perception of success and failure in the venture capital ecosystem. At its heart, the paradox of the power law is a reality every serious investor must embrace to thrive.

What is the Power Law in Venture Capital?

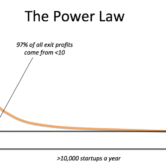

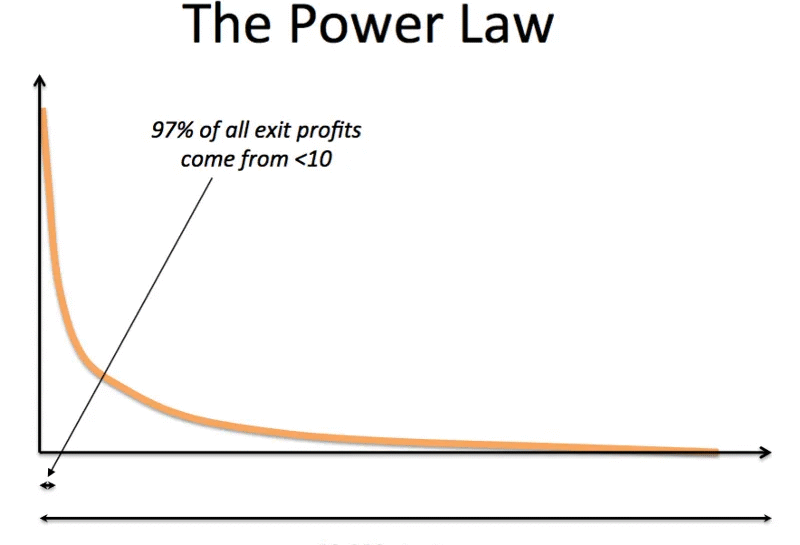

The power law describes a distribution where a small number of investments account for the vast majority of returns. In venture capital, this means that one or two portfolio companies can produce returns so massive that they overshadow the performance of every other investment combined.

Rather than a normal distribution where outcomes cluster around an average, the power law curve is highly skewed. A few outliers succeed beyond expectation, while the majority either fail or deliver modest results. As seasoned investors, we understand that recognising and accepting this distribution is crucial to achieving long-term success.

Why Venture Capital Follows the Power Law

Several factors contribute to the power law phenomenon in venture capital:

- Scalability of Tech Ventures: Startups, particularly in the technology sector, can scale exponentially. A software company can serve millions globally without proportionally increasing costs.

- Network Effects: Businesses that benefit from network effects grow stronger with each new user, creating a dynamic where only the strongest survive.

- Market Dynamics: Emerging markets reward first-movers and dominant players disproportionately.

Therefore, the VC landscape naturally amplifies outlier outcomes, leading to highly concentrated returns.

The Paradox: Failure Is a Feature, Not a Bug

The true paradox lies in the fact that failure is not only typical but also expected. Traditional investment logic values consistency and low variance. In contrast, venture capitalists must be prepared to accept high variance outcomes.

The mindset shift necessary for success includes:

- Backing Risky Ventures: Safe bets rarely produce outsized returns.

- Enduring High Failure Rates: Most investments will not achieve meaningful exits, and that’s acceptable.

- Focusing on Potential Scale: We prioritise companies with the potential to dominate billion-dollar markets over those offering predictable but limited returns.

Thus, failure is not merely tolerated; it is an integral part of the strategy.

Portfolio Construction in a Power Law World

Constructing a venture portfolio under the influence of the power law requires a deliberate approach:

Invest in a Broad Range of Startups

Diversification increases the likelihood of capturing a breakout success. Concentrating on a small number of investments might feel safer, but it reduces the chances of encountering an outlier.

Bet Boldly on Potential Outliers

Rather than spreading bets thinly, venture capitalists must be willing to double down on companies showing signs of extraordinary potential. Follow-on investments in top performers are crucial for maximising returns.

Adopt a Long-Term Perspective

It takes time for true power law winners to emerge. Early failures should not deter continued support for promising portfolio companies.

Identifying Power Law Potential Early

Recognising which companies could become power law winners is more an art than a science. However, specific characteristics often correlate with outsized outcomes:

- Exceptional Founders: Visionary leadership combined with relentless execution ability.

- Massive Addressable Markets: A small market limits potential returns, regardless of execution.

- Differentiated Products: Offering something unique and defensible is key to dominating a space.

- Scalability: The business model must allow rapid growth without a proportional increase in costs.

Due diligence and pattern recognition become paramount in assessing these traits.

Managing the Psychological Toll of the Power Law

The emotional demands of venture investing under a power law distribution are considerable. Frequent failures, the slow emergence of winners, and the temptation to lose faith can erode discipline.

We mitigate these challenges by:

- Establishing Clear Expectations: Educating stakeholders about the true nature of venture returns.

- Celebrating Learning, Not Just Winning: Each failure provides insights that strengthen future decision-making.

- Remaining Patient: Power law outcomes unfold over years, not months.

Maintaining emotional resilience is as critical as making astute investments.

Exit Strategies and Timing Under the Power Law

In venture capital, timing exits properly is crucial. Selling too early can mean forfeiting massive upside; holding too long can expose investors to deteriorating business fundamentals.

Strategies we employ include:

- Participating in Growth Rounds: Investing in follow-on rounds to increase exposure to top performers.

- Secondary Sales: Partial liquidity events allow de-risking while retaining upside potential.

- M&A Opportunities: Proactively positioning companies for acquisition can sometimes optimise outcomes, especially when public markets are unfavourable.

Every exit decision must balance the trade-off between realised gains and potential future value.

Real-World Examples of Power Law Dynamics

Numerous historical examples illustrate the power law in venture capital:

- Sequoia Capital’s investment in WhatsApp: A $60 million investment turned into over $3 billion after Facebook’s acquisition.

- Benchmark Capital’s stake in Uber: Their early bet in Uber yielded returns that eclipsed the rest of their fund combined.

- Accel’s backing of Facebook: A relatively modest early-stage investment translated into astronomical gains.

In each case, a single investment defined the financial success of an entire fund.

Implications for New Venture Capitalists

For emerging fund managers and angel investors, understanding and adapting to the power law is critical.

This entails:

- Emphasising Deal Flow: Seeing more deals increases the chances of backing an outlier.

- Building Relationships with Founders: Early access to the best opportunities often comes through trusted networks.

- Developing Pattern Recognition: With experience comes the ability to spot companies poised for breakout success.

New entrants who embrace the unpredictability of the power law will position themselves to achieve extraordinary outcomes.

Conclusion: Mastering the Power Law for Venture Success

Mastery of the power law is not optional—it is the foundation of successful venture investing. Embracing the paradox that many failures lead to a few spectacular successes enables venture capitalists to navigate the volatile, high-stakes world of startup investing with wisdom and resilience.

We must seek out scalable businesses, back exceptional founders, and remain steadfast in the face of inevitable turbulence. In doing so, we position ourselves not only to survive but to achieve the kind of breakout successes that define legendary venture funds.