From Pitch to Partnership – How to Build, Communicate, and Close Like a Pro

By Upstart – India’s First Full-Cycle Fundraising Accelerator

Introduction: Why This Guide Exists

Thousands of promising startups never get funded—not because they’re bad businesses, but because their fundraising strategy is broken.

At Upstart, we believe that clarity is currency, and this guide provides just that.

You’ll find actionable insights on:

- What VCs are looking for in 2025

- How to position your startup at each stage

- The 3 critical assets every founder must master

- What kills funding chances (and how to fix it)

- The perfect pitch formula

- And how Upstart helps you turn capital into a real growth engine

Let’s get you investor-ready.

Chapter 1: Understanding the Fundraising Landscape in 2025

It’s not 2015 anymore.

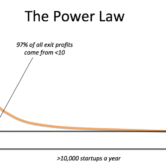

The VC game has changed. In today’s environment, capital is available—but only to clear, compelling, and confident startups.

What matters now:

- Traction first, capital second – VCs expect progress before cheques.

- Narrative power – Ideas don’t raise money. Convincing stories do.

Segment alignment – Investors are focusing on specific hot sectors.

What Changed?

In earlier years, big ideas and vision raised funds. Now, VCs want:

- Actual execution capability

- Demonstrated demand

- And proof that your startup can scale profitably

This shift means you must play the long game with structured milestones.

Chapter 2: Stage-Wise Expectations – Where Do You Stand?

| Stage | Traction | Revenue | Growth | Team Size | Valuation |

| Pre-Seed | Early users / MVP | $0–$50K | 0–20% MoM | 2+ | SAFE / 10–15% equity |

| Seed | Product-Market Fit | $50K–$200K | 15–30% MoM | 5+ | Priced Round (15–25%) |

| Series A+ | PMF + GTM Fit | $200K+ | 25%+ MoM | 10+ | Valued at $6M–$30M+ |

Founders must self-assess honestly: Are you pitching above your readiness?

Chapter 3: What Makes a Startup “Fundable”?

It’s a mix of three ingredients:

Criteria | Okay | Good | Great |

Team | Just started | Proven expertise | Previous exits/network |

Product | MVP | 10x better solution | Unmatched differentiation |

Traction | Waitlist or press | MoM growth | Undeniable adoption |

GTM Strategy | Paid ads | Early channel wins | Viral/community-led |

VCs don’t just fund products—they fund fundable entrepreneurs.

Chapter 4: Why Startups Fail to Raise – The “Investment Killers”

Killer #1: Poor Communication

You may have a great idea, but you can’t explain why it’s investable.

Upstart Maxim #1: “Great ideas don’t raise funds. Great communication does.”

Killer #2: No Investor Targeting Strategy

You’re pitching to anyone and everyone, with no alignment.

Upstart Maxim #2: “Investors back focused campaigns. Demand creates FOMO.”

Chapter 5: The Three Critical Fundraising Assets

- The Plan

Shows you’re serious, strategic, and scalable.

Includes:

- Short & long-term vision

- GTM strategy

- Exit optionality

- Competitive analysis

- The Projections

Not guesses—financial storytelling.

Includes:

- 3–5 year revenue model

- P&L + Cash flow

- Balance sheet

- KPIs + dashboard

- The Pitch

This isn’t a slideshow. It’s your fundraising weapon.

The Perfect Pitch = Time-worthy, not money-begging.

Chapter 6: The 5-Act Structure of a Powerful Pitch

- The Hook – Trigger emotion, urgency, or vision

- The Essence – What you do and why it matters

- The Evidence – Show demand with data

- The Plan – How you’ll scale, succeed, and win

- The Ask – What you want + how they join the mission

This structure isn’t theory—it works because it creates emotional buy-in + logical confidence.

Chapter 7: Building Investor Demand – Your Campaign Strategy

Step 1: Investor Targeting

Don’t chase. Filter based on:

- Sector match

- Investment stage fit

- Value alignment

Step 2: Outreach

Use:

- Warm intros

- Cold campaigns

- Databases

- Applications to curated groups

Step 3: Follow-Up

Meetings, DD, closing.

Remember: FOMO = Follow-Up Optimized.

Chapter 8: How Upstart Helps You Win

We’ve built India’s only full-cycle fundraising accelerator, not just a deck service.

In 12 weeks, you get:

✅ Investor-ready pitch + projections

✅ Personalized mentor support

✅ Targeted outreach + introductions

✅ Confidence to close faster

Our clients are:

- 40x more likely to raise

- $150M+ raised across 400+ startups

- 100% equity retained—we don’t take a cut

What Founders Say

“The best business support I’ve ever received.”

“A game-changer for my fundraising.”

“Within 90 days, I went from chaos to clarity.”

Final Thoughts

Raising capital in 2025 isn’t about luck.

It’s about structure, storytelling, and strategy.

If you’re serious about turning your startup into an investable company, you don’t have to figure it out alone.

Ready to take the next step?

- Schedule a 1:1 session

- Join the PitchReady program

- Request your personalized playbook

We’ll walk with you—from pitch to partnership—and beyond.

Upstart – Fundraising. Reimagined. https://myupstart.com