Investor Psychology: What VCs Look for in Startups

By Upstart Experts

Raising venture capital isn’t just about having a game-changing idea. It’s about knowing how investors think. Many founders assume that VCs fund innovation alone—but that’s far from the truth.

Venture capitalists assess startups through a mix of psychology and strategy. They weigh risk against reward. They scrutinize team dynamics, market potential, and scalability. An idea might be brilliant, but if the execution looks shaky, the funding won’t come.

So, how do you align with an investor’s mindset? You need to understand what drives their decisions. What makes them say yes? What sends them running? Positioning your startup to match investor expectations isn’t just helpful—it’s essential.

In this guide, we’ll break down the psychology behind investor decisions and give you the tools to pitch with confidence. By the end, you won’t just attract funding—you’ll know exactly how to secure it. Let’s dive in!

1. Understanding the VC Mindset

Risk vs. Reward: The VC Equation

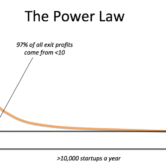

Venture capitalists operate on a high-risk, high-reward investment model. Out of 10 investments, they expect one or two to yield significant returns while several may fail. They aim to identify startups with unicorn potential—companies capable of scaling to billion-dollar valuations.

How Founders Can Leverage This:

- Demonstrate an ample, high-growth market opportunity.

- Present a clear path to exponential revenue growth.

- Address potential risks with data-backed mitigation strategies.

VCs Invest in Teams, Not Just Ideas

Even the most disruptive ideas require a strong execution team. Investors prioritise startups led by resilient, adaptable, and high-performing founders.

How Founders Can Leverage This:

- Highlight your team’s expertise, track record, and leadership capabilities.

- Showcase your ability to navigate challenges and pivot effectively.

- Build a complementary founding team with technical and business acumen.

2. Key Factors VCs Look for in a Startup

Market Size and Growth Potential

Investors seek startups that target large, scalable markets with room for significant growth. A small or niche market limits the potential for high returns.

How Founders Can Leverage This:

- Clearly define your Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM).

- Use industry trends, research, and market projections to support growth claims.

- Present a well-structured go-to-market strategy that captures market share effectively.

Unique Value Proposition & Competitive Advantage

VCs avoid startups without a distinct edge. They need to see what makes your product irreplaceable.

How Founders Can Leverage This:

- Articulate a compelling unique value proposition (UVP).

- Demonstrate how your product solves a significant pain point better than competitors.

- Provide customer validation, case studies, and testimonials.

Revenue Model & Profitability Potential

A groundbreaking product is not enough—investors must see how it can become a sustainable, profitable business.

How Founders Can Leverage This:

- Showcase a scalable business model with high margins.

- Highlight predictable revenue streams (e.g., SaaS, subscriptions, enterprise contracts).

- Clearly define your unit economics (Customer Acquisition Cost vs. Lifetime Value).

Traction & Proof of Concept

VCs are more likely to invest in startups that demonstrate traction, as it serves as proof of product-market fit.

How Founders Can Leverage This:

- Present growth metrics, user adoption rates, and revenue milestones.

- Highlight strategic partnerships and key customer wins.

- Show tangible evidence of repeat customers and increasing engagement.

Exit Strategy & ROI for Investors

Investors need to understand how they will eventually realise a return on their investment. Common exit strategies include acquisition, IPO, or secondary market sales.

How Founders Can Leverage This:

- Outline realistic exit scenarios and acquisition targets.

- Showcase successful comparables (exits within your industry).

- Demonstrate your company’s long-term scalability and liquidity potential.

3. The Art of Pitching: Psychology of Investor Engagement

Building Trust and Credibility

Investors back founders they trust. The ability to inspire confidence significantly impacts funding outcomes.

How Founders Can Leverage This:

- Be transparent about potential risks and demonstrate a proactive approach to mitigating them.

- Use data-driven insights to back your claims.

- Exhibit passion, confidence, and commitment to your startup’s vision.

Storytelling: The Hidden Key to Winning Investors’ Hearts and Minds

While data and financials are essential, investors connect with compelling narratives. A strong storytelling approach makes your pitch memorable and persuasive.

How Founders Can Leverage This:

- Craft a powerful startup story that emotionally resonates with investors.

- Follow a problem-solution-impact framework.

- Align your startup’s mission with a broader vision for the industry.

4. How Upstart Gives Founders the Winning Edge

Raising capital isn’t just about having a great idea—it’s about knowing how to sell it. At Upstart, we don’t just introduce you to investors; we help you win them over. Our accelerator program is designed to sharpen your pitch, strengthen your business model, and get you investor-ready.

Here’s how we set you up for success:

- Investor Pitch Training: Learn how to craft a compelling story that grabs attention and builds trust.

- Scalable Business Model Development: We help refine your strategy so investors see long-term growth potential.

- Exclusive Investor Access: Get direct introductions to VCs, angel investors, and strategic partners who can fuel your startup.

- Fundraising Guidance: Navigate term sheets, negotiations, and investment rounds with expert support.

Ready to master investor psychology and secure the funding you need? Apply to Upstart today and take your startup to the next level.