The venture capital landscape in India has undergone transformational shifts in 2024. As we dive deep into the India Venture Capital Report 2024, we observe a resilient, adaptive, and dynamic ecosystem that continues to attract global investors, innovative startups, and ambitious entrepreneurs.

This report outlines key trends, sectoral growth, investment patterns, and future forecasts that define the current and upcoming state of venture capital in India.

Indian Venture Capital Market Overview

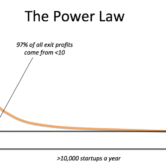

India’s venture capital market witnessed a strategic recalibration in 2024. Total venture capital funding surpassed $28 billion, marking a steady recovery from the lows of the global slowdown in 2022-2023. While the deal volume slightly declined, deal quality improved, indicating a more selective and strategic approach from investors.

Key Highlights:

- Early-stage funding grew by 18% YoY, showcasing renewed optimism.

- Late-stage investments experienced a slight contraction of 5%, with a focus on profitability and scalability.

- Cross-border investments contributed to 25% of the total funding activity.

A younger demographic, digital penetration, and a vibrant entrepreneurial spirit have significantly fueled India’s emergence as a global innovation hub.

Sector-wise Investment Analysis

Technology and SaaS: Driving Innovation

The Technology and SaaS sector continued to dominate venture capital inflows, accounting for nearly 35% of the total investment. Indian SaaS startups are increasingly capturing global markets, propelled by:

- AI and Machine Learning advancements

- Remote working technologies

- Enterprise automation demands

The top-funded Saas startups in 2024 include Postman, Freshworks, and emerging newcomers in DevOps and cloud-native security.

Fintech: Reinventing Financial Ecosystems

Fintech remained a critical magnet for venture capital with $6 billion in total funding. Key growth drivers included:

- Digital lending platforms

- Wealth management tools

- Blockchain-based solutions

- Insurance tech innovations

Despite regulatory tightening, investors continued backing compliance-ready fintech startups that addressed financial inclusion and rural banking gaps.

Healthtech and Biotech: Emerging Stronger Post-Pandemic

Healthtech and biotech investments grew by 22% YoY, reflecting a heightened focus on healthcare innovation. Areas of interest included:

- Telemedicine platforms

- Health AI applications

- Affordable diagnostic solutions

- Biotechnology research for global health challenges

Notable success stories include PharmEasy’s expansion, CureFit’s profitability push, and several AI-based diagnostic startups that have attracted significant Series A rounds.

Consumer Tech and D2C: Redefining Consumer Behaviour

The Direct-to-Consumer (D2C) boom continued with brands leveraging social commerce, influencer marketing, and AI-driven personalisation. Sectors gaining traction were:

- Beauty and personal care

- Sustainable fashion

- Health food and supplements

Investors favoured brands with strong unit economics, repeat purchase metrics, and global expansion plans.

Geographic Trends in Venture Capital Investment

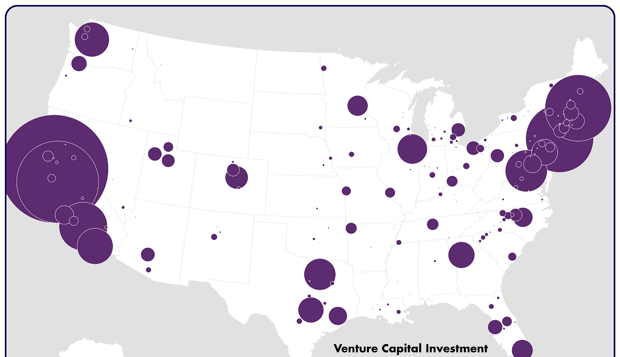

While Bengaluru remained the uncontested startup capital, cities like Hyderabad, Pune, and Chennai showcased accelerated growth in venture capital deals. Additionally, Tier 2 and Tier 3 cities have demonstrated emerging startup ecosystems, backed by local angel networks and government initiatives such as Startup India.

International Interest in Indian Startups

Global investors from the United States, Japan, Southeast Asia, and the Middle East have actively increased their allocations to India. Funds such as SoftBank, Tiger Global, Sequoia India, Accel, and Lightspeed continued to demonstrate a long-term commitment, while newer players like ADQ and Mubadala from the UAE entered the landscape aggressively.

Trends Shaping Indian Venture Capital in 2024

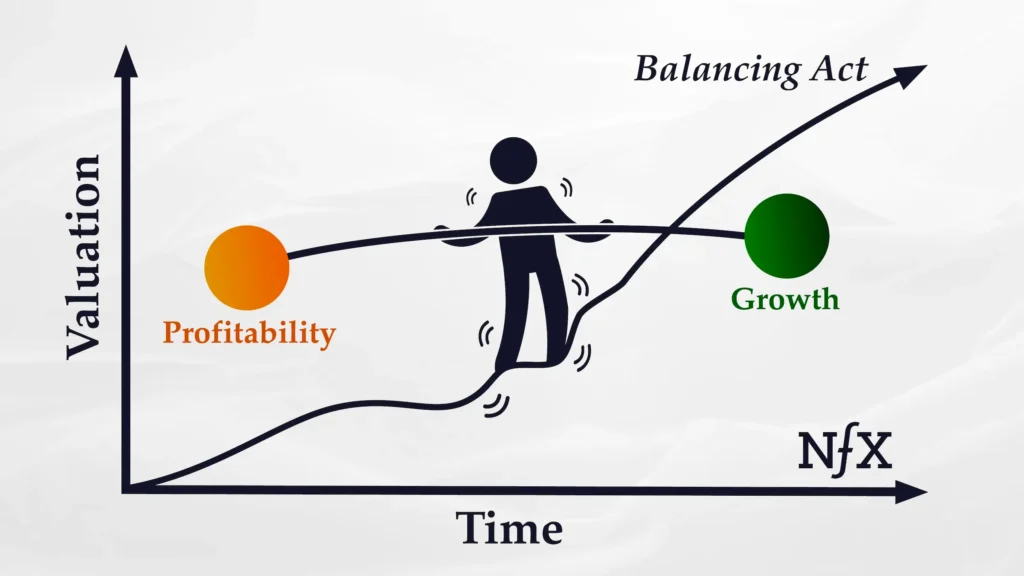

Focus on Profitability Over Growth

The days of growth-at-any-cost are behind us. Investors in 2024 are emphasising:

- Path to profitability

- Cash flow management

- Unit economics

Startups are expected to demonstrate realistic business models and financial discipline earlier in their journey.

Rise of ClimateTech and Impact Investing

Investments in climate tech, sustainable energy, and impact-driven startups increased by 35%. This aligns with India’s broader push towards Net Zero 2070 goals and ESG compliance becoming central to investment decisions.

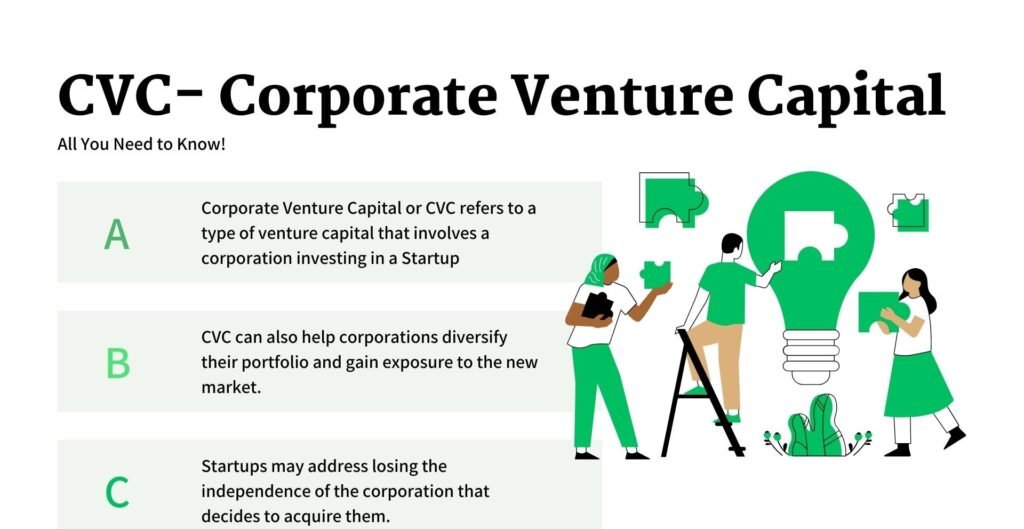

Corporate Venture Capital (CVC) on the Rise

Large corporations across various sectors are establishing venture arms to tap into the startup ecosystem. Entities like Reliance Ventures, Tata Digital Ventures, and Aditya Birla Ventures are leading corporate participation in:

- Strategic investments

- Startup acquisitions

Innovation partnerships

Gender Diversity and Inclusive Funding

There is an increasing awareness and conscious effort towards funding women-led startups and diverse founding teams. VC firms have launched exclusive funds to support women entrepreneurs and underrepresented founders.

Challenges Faced by the Venture Capital Ecosystem

Despite the optimistic outlook, several challenges persist:

- Regulatory uncertainty around sectors like fintech and crypto

- Valuation corrections are causing longer fundraising cycles.

- Global geopolitical risks affecting cross-border investments

- The exit environment remains complex, with delayed IPO plans and secondary sales gaining popularity.

VCSS and startups must navigate these challenges by maintaining resilience, flexibility, and proactive risk management.

Future Outlook for Venture Capital in India

The Indian venture capital ecosystem is positioned for long-term robust growth. As the world’s third-largest startup ecosystem, India offers:

- A massive consumer base

- Talent-rich technology workforce

- Increasing government support through policies and infrastructure

- Accelerating digital adoption

By 2025, experts forecast that:

- Early-stage funding will continue its upward momentum

- Sector-specific funds, such as ClimateTech, Healthtech, and AgriTech, will proliferate.

- Exit opportunities will diversify through mergers and acquisitions (M&A) activity and global listings.

Investors who adapt to India’s unique dynamics and focus on value creation rather than vanity metrics will emerge as long-term winners.

Conclusion

The India Venture Capital Report 2024 paints a picture of a mature, disciplined, and globally attractive investment destination. Startups embracing innovation, scalability, and sustainability will command investor interest. Meanwhile, VC firms focusing on operational excellence, strong networks, and founder-first philosophies will shape India’s next generation of unicorns and decacorns.

At the heart of it, India’s venture story is just beginning, and the world is watching — and investing—with bated breath.