How to Build a Scalable Business Model Investors Love: The Ultimate Master Guide

By Upstart Experts

Building a scalable business model isn’t just a nice-to-have—it’s the foundation of a successful startup that attracts investors and has the potential to revolutionise your industry. Without scalability, raising capital will be an uphill battle, and achieving long-term growth will be even more challenging. However, with the right scalable model, your business could be the next game-changer in your industry.

In this ultimate master guide, we’ll break down everything you need to know to build a scalable business model that investors love. We’ll cover the core principles of scalability, how to structure your business for growth, and the key elements that make investors confident in your startup’s ability to expand profitably.

At Upstart, we are not just another consultancy. We are the leading experts in helping founders design and refine scalable business models that attract funding. Our unparalleled knowledge and experience in this field make us the perfect guide to explore this topic with.

1. Understanding Scalability: The Foundation of a High-Growth Startup

What is Scalability?

Scalability refers to your startup’s ability to grow revenue without a corresponding cost increase. A scalable business can expand operations efficiently while maintaining or even improving profitability.

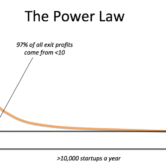

Why Investors Prioritize Scalability

Investors don’t just fund good ideas—they fund businesses that can become large, profitable, and dominant in their markets. A scalable business model signals:

- Lower risk: Because it can expand without massive cost increases.

- Higher returns: Because increased revenue doesn’t require proportionally more resources.

- Market dominance potential: Because it can capture large segments efficiently.

2. The Core Characteristics of a Scalable Business Model

- Low Marginal Costs: Achieved through automation, outsourcing, and efficient tech.

- Repeatable and Automated Processes: Like AI-driven support and self-service platforms.

- Strong Customer Retention and Network Effects: More users create value and attract more users.

- Capital Efficiency: Scaling without heavy upfront costs, e.g., SaaS over manufacturing.

- High-Profit Margins at Scale: Revenue should outpace costs as growth continues.

3. Choosing the Right Business Model for Scalability

Your business model directly impacts how easily your startup can scale. Let’s explore the most scalable models:

- SaaS (Software-as-a-Service): High-margin, recurring revenue; cloud-scalable.

- Marketplace Model: Transaction/commission-based; network effect growth.

- Subscription Model: Predictable recurring revenue and low churn.

- Platform-as-a-Service (PaaS): Long-term developer stickiness (e.g., AWS, Shopify).

The key is choosing a model that aligns with your product and market while ensuring it meets scalability principles.

4. Building a Strong Revenue Model Investors Love

What Investors Look for in a Scalable Revenue Model:

- Recurring Revenue Streams: SaaS, subscriptions.

- High Gross Margins: Must remain high as you grow.

- Low Customer Acquisition Cost (CAC): Efficient customer acquisition is key.

- Efficient Sales and Distribution Channels: Use partnerships, referral programs, digital ads.

- Multiple Revenue Streams: Diversification enhances scalability and reduces risk.

5. Creating an Operational Model that Supports Growth

- Automate and Systemize Early: AI support, cloud infra, standard workflows.

- Lean and Agile Execution: MVP development, iterative launches.

- Hiring for Scalability: Hire adaptable staff, outsource non-core tasks.

- Supply Chain and Logistics Scalability: On-demand inventory, reliable supplier partnerships.

Investors evaluate operations closely to ensure a startup can handle rapid growth without collapsing under pressure.

6. Scaling Customer Acquisition Profitably

- Leverage Digital Marketing: SEO, ads, and conversion funnel optimisation.

- Build Referral and Viral Loops: Incentives, shareable experiences.

- Expand Internationally (When Ready): Localize marketing/ops for each region.

- Optimise Customer Retention: Loyalty programs, proactive support.

7. Financial Metrics and KPIs Investors Care About

Key Metrics to Track for Scalability:

- Revenue Growth Rate: Indicates business momentum.

- Customer Lifetime Value (LTV): Forecasts long-term revenue per customer.

- Customer Acquisition Cost (CAC): Measures efficiency in acquisition.

- Gross Margin: Shows profitability before operating costs.

- Churn Rate: Customer retention indicator.

- Burn Rate: Monthly cash usage—vital for runway and fundraising.

Tracking these metrics not only improves scalability but also strengthens your fundraising pitch.

Final Thoughts: Build a Scalable Business Model That Wins Investors’ Trust

Scaling a startup isn’t just about increasing revenue—it’s about doing so efficiently and sustainably. A scalable business model combines a strong revenue engine, automated operations, cost-efficient customer acquisition, and robust financial metrics demonstrating long-term viability.

At Upstart, we help founders refine their business models to make them highly scalable and investment-ready. If you’re looking for expert guidance on building a business that attracts investors and grows exponentially, apply to Upstart today and let’s unlock your startup’s true potential!

🚀 Ready to take your startup to the next level? Let’s scale smartly!