The Ultimate Fundraising Roadmap for Startup Founders

By Upstart Experts

Raising capital is a pivotal journey for any startup, often determining its fate. The line between securing funding and facing challenges can be razor-thin, depending on how well you prepare, strategise, and execute your plans. This roadmap, crafted by Upstart after collaborating with countless founders, serves as a strategic guide to help you navigate the fundraising landscape and connect with the right investors for your startup.

Phase 1: Laying the Foundation—Investor Readiness

Raising funds isn’t just about having a great idea—it’s about proving you’re ready. Many startups fail at fundraising simply because they skip the groundwork. Investors don’t write checks based on potential alone; they invest in businesses that can back up their vision with data, strategy, and traction. Before you step into a pitch meeting, make sure you’ve covered these key areas.

1. Validate Your Market—Not Just Your Idea

- Investors need proof that there’s demand for your solution, not just a great concept.

- 42% of startups fail because there’s no real market need (CB Insights). Don’t be part of that statistic.

- Show traction—early revenue, a growing user base, or strong partnerships prove customers are willing to pay.

2. Build a Business Model That Scales

- Investors want to see how you’ll grow, not just what you do.

- Your revenue streams should be sustainable and scalable—can your model expand profitably?

- Startups with recurring revenue models are three times more likely to secure funding (McKinsey). Consider subscriptions or other predictable income sources.

3. Get Your Financials in Check—No Guesswork Allowed

- Investors expect realistic financial projections for the next 3–5 years, backed by data.

- Understand your unit economics—how much it costs to acquire a customer and the revenue they generate.

- 70% of failed startups scaled too soon without solid financial planning (Business Review). Keep an eye on your burn rate and runway.

Phase 2: Crafting a Winning Pitch

With a solid foundation in place, it’s time to prepare a pitch that captivates investors and instills confidence. A compelling pitch can significantly increase your chances of securing the right investors.

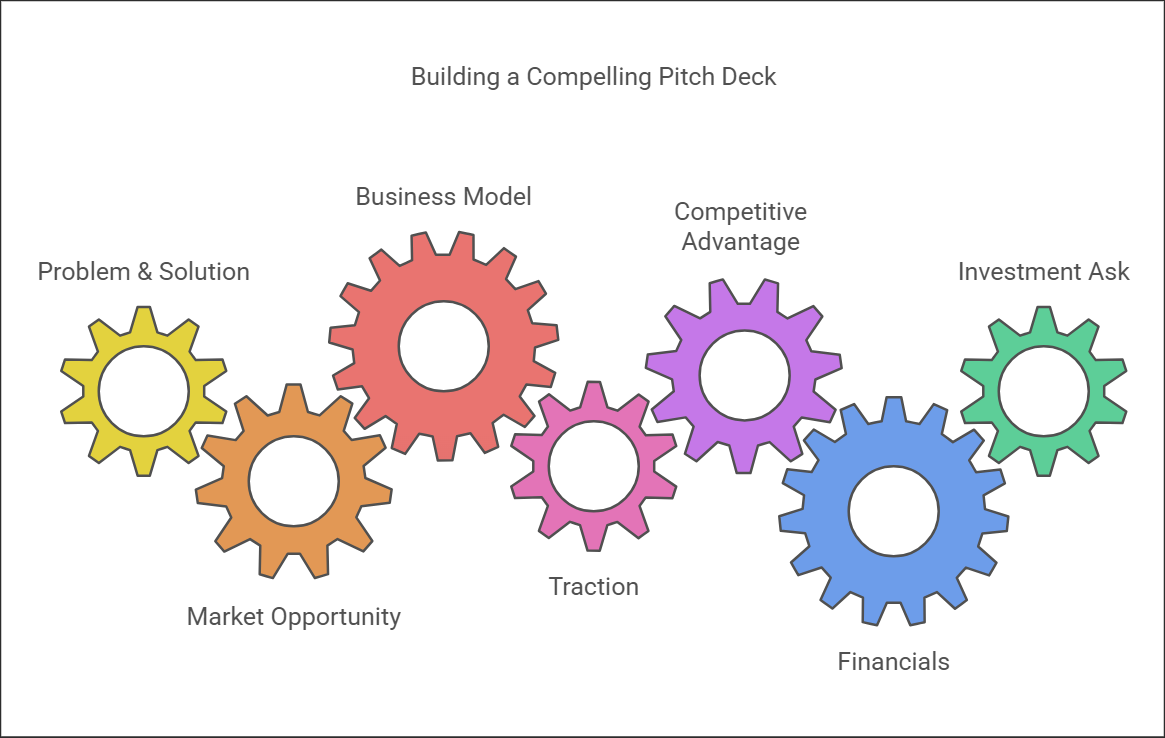

4. Create a High-Impact Pitch Deck

- Problem & Solution: Why does your startup exist?

- Market Opportunity: How big is the opportunity? (Use third-party reports to validate market size.)

- Business Model: How will you make money?

- Traction: What progress have you made so far? (Include revenue, user growth, partnerships.)

- Competitive Advantage: What sets you apart?

- Financials: Where is your startup headed?

- Investment Ask: How much are you raising and for what?

5. Master the Art of Storytelling

- Investors make decisions emotionally, then justify them logically. Your pitch should spark excitement and build trust.

- A compelling narrative makes your startup unforgettable. Frame your pitch as a journey investors want to be part of.

- Connect to a broader vision. The best pitches aren’t just about the product—Airbnb didn’t pitch home rentals; they pitched belonging anywhere.

6. Prepare for Tough Questions

- Expect tough questions. Investors will challenge your valuation, assumptions, and go-to-market strategy.

- Be ready to defend key metrics. Know your unit economics, customer acquisition costs, scalability, and market risks inside out.

- Rehearse relentlessly. Work with mentors, accelerators, and advisors to refine your pitch. The tougher your practice, the smoother your real investor meetings will be.

Phase 3: Finding the Right Investors

Not all investors are the same. Targeting the right ones increases your chances of closing a successful round.

7. Build a Targeted Investor List

- Research investors who have funded startups in your industry.

- Look for those who bring strategic value beyond money.

- Use platforms like Crunchbase, AngelList, and LinkedIn to identify prospects.

- According to AngelList, investors specialising in your sector increase the likelihood of funding success by 60%.

8. Warm Introductions Are Key

- Cold emails rarely work. Leverage your network, mentors, and accelerator programs like Upstart to get direct introductions.

- Personalised treatment with a strong hook can make the difference. An intro from a trusted source increases the chances of an investor responding by over 80%.

Phase 4: Investor Meetings & Closing the Deal

Getting in the room is one thing—winning over investors is another. Here’s how you can maximise your investor meeting.

9. Deliver with Confidence & Clarity

- Investors want to back founders with confidence and know their business inside out.

- Keep your pitch concise and be ready to adapt based on investor feedback.

- Use data to support your claims. According to Sequoia Capital, the most successful fundraising pitches combine compelling storytelling with complex data.

- Don’t just chase the highest valuation—look for smart capital that aligns with your vision.

- Before signing a deal, understand key terms like equity dilution, preferred shares, and liquidation preferences.

- Studies show that startups that negotiate investor-friendly terms early on avoid significant conflicts.

10. Due Diligence & Closing the Round

- Investors will scrutinise the legal, financial, and operational documents.

- Preparing a data room with all essential documents will speed up the process.

- Once the deal is finalised, ensure clear communication on fund disbursement and investor expectations.

- On average, closing a funding round takes 3-6 months. Plan your runway accordingly.

Final Thoughts: Fundraising is a Process, Not an Event

Successful fundraising isn’t a matter of luck; it’s about strategy. The most investable startups are those that prepare, execute, and refine their approach relentlessly. At Upstart, we empower founders with the right tools, investor connections, and mentorship to help them secure funding and scale their businesses.

If you’re serious about raising capital, don’t navigate this journey alone. Apply to Upstart today and gain access to expert fundraising support, tailored investor matchmaking, and hands-on mentorship to accelerate your success.