This Is Not About Raising Funds. It’s About Becoming Fundable

Every founder wants to raise capital. But the real question is:

If you weren’t you — if you were a calm, discerning investor, Would you write a ₹50 lakh cheque to the person staring back at you in the mirror?

This article is not just a how-to. It’s a wake-up call.

Because fundraising isn’t an event. It’s not a sprint. It’s a mirror. A test. A transformation.

The Fundraising Myth

We’ve been sold a narrative:

“Raise money. Then build something great.”

But the truth is:

Build something so great they can’t afford to ignore you.

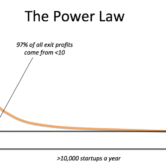

Money chases momentum. Not desperation. Not ideas. Not fancy pitch decks made in Canva.

What Most Founders Miss

They chase capital. But miss clarity.

They polish decks. But avoid discomfort.

They send cold emails. But forget to build something warm — Something real, that people actually want.

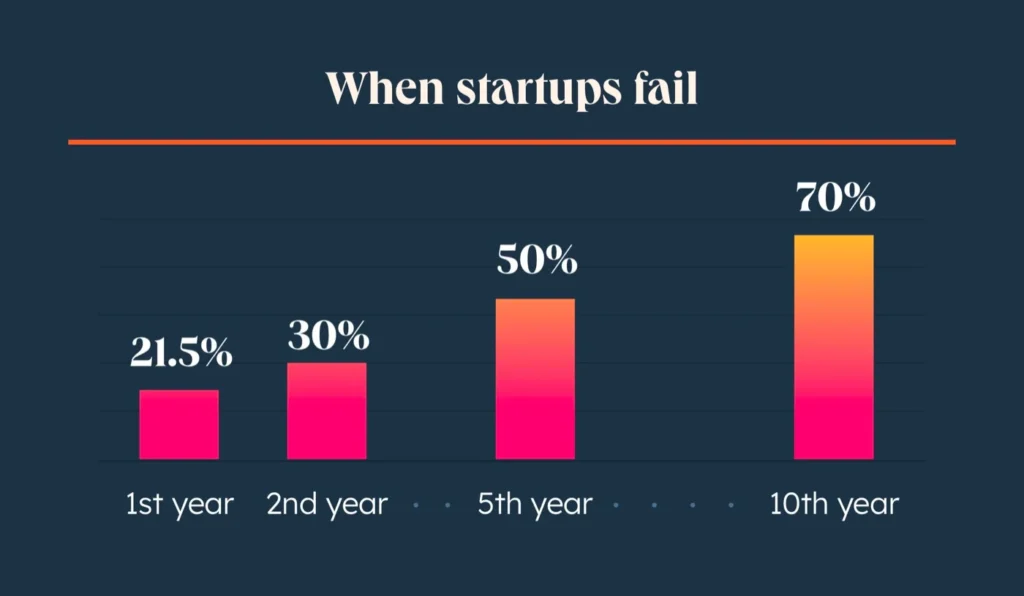

Let’s Be Honest. Here’s Why Most Startups Don’t Raise

There are two killers that quietly take them down:

1. They can’t communicate their value.

Not with words. Not with numbers. Not with presence.

They speak about features when investors listen for outcomes. They sell hope when investors buy proof.

2. They knock on the wrong doors.

Wrong investor. Wrong timing. Wrong ask.

It’s like selling a submarine to a cyclist.

What Investors Really Want (But Rarely Say)

They don’t want to read a pitch. They want to feel your clarity.

They’re not hunting the next unicorn. They’re hunting certainty.

Certainty that you are not guessing. Certainty that you know your numbers. Certainty that you’ve been punched by the market — and got up stronger.

The Three Things You Must Master (Before Asking for a Dime)

You don’t need a hundred pages. You need three assets — not on paper, but in your bones:

1. A Plan

Not a fantasy. A real, gritty plan that shows how ₹1 becomes ₹5 — and why.

Short-term, long-term, go-to-market, path to breakeven, use of funds — yes. But more than that: a reason to believe.

2. Projections

Not Excel sorcery. But assumptions with soul. Numbers that whisper truth. Revenue that’s earned, not imagined. A burn rate that reflects your wisdom, not your wish list.

3. A Pitch

Not slides. Not jargon. Not buzzwords. A story. A spine. A signal that says: “I get it. I’ve lived it. And I’m not here to waste your time.”

The Real Game: Becoming Investable

You are not raising funds. You are raising belief.

You’re asking a stranger to believe in:

- Your judgment under stress

- Your ability to lead a team when things fall apart

- Your wisdom with their money

To do that, you must become three things:

- Resourceful: You know how to attract, not just chase.

- Financially intelligent: You speak the language of ROI, not just KPIs.

- Commercially obsessed: You understand markets, margins, and momentum.

“Great founders are not built in pitch meetings. They’re built in execution.” — A lesson 600+ of our clients learned. The hard way or the Venture Care way.

The Moment of Truth

So ask yourself:

- Am I the kind of founder I would bet on?

- Do I have a business that deserves investment — not just needs it?

- Have I built the discipline before I ask for the capital?

If the answer is “not yet” — good. Because now you can stop chasing and start becoming.

What to Do Next

Don’t send your deck. Not yet.

Sit down with yourself. Draw your path to breakeven. Define your inflection point. Write your investor’s reward on a sticky note.

Then — and only then — ask for capital. Not to survive. But to scale what’s already working.

We Help Founders Become Worth Investing In

At Venture Care, we don’t just help you raise. We help you earn the right to raise.

We work with founders to:

- Build investor-grade pitch decks and projections

- Design campaigns that speak to the right investors

- Close rounds without burning 12 months and ₹ 10 L in random hustle

If you’re ready to stop selling and start attracting, join the founders who raise smart, scale fast, and stay sane. Visit https://venture-care.com/ or call +91 9172713075

Final Thought

Fundraising is not a finish line. It’s a milestone. And real founders don’t just get funded.

They become fundable.